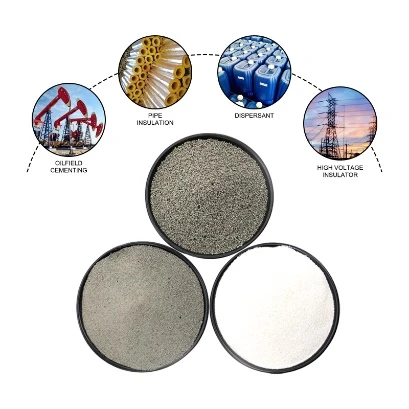

Runhuabang Tourmaline powder manufacturers supply black grey Tomalin tourmaline powder

Back to list

Th1 . 30, 2025 05:23

The pricing of zeolite per ton is a dynamic factor in the materials industry, influenced by various elements that both buyers and sellers need to consider. This naturally occurring mineral, prized for its adsorption properties, catalytic uses, and as an ion-exchange medium, forms a crucial part of a broad range of industries, from environmental engineering to agronomy.

4. Geopolitical and Environmental Considerations Political stability in zeolite-rich regions affects mining operations and export capabilities. Similarly, stringent environmental regulations can enhance costs due to the need for compliance with higher environmentally-friendly standards. Both factors can induce price shifts. 5. Market Competition The presence of competitors within the market, offering either alternative materials or different sources of zeolite, adds another layer of pricing complexity. A competitive market can mitigate drastic price changes, yet an unbalanced market where a few companies dominate can lead to increased prices due to monopolistic tendencies. 6. Emerging Market Trends As we move towards a more environmentally conscious world, zeolite's role in promoting cleaner technologies is under the spotlight. Emerging trends include their use in green technologies—like air filtration, wastewater treatment, and renewable energy systems—which can spike demand, thereby influencing pricing. For businesses considering integrating zeolite in their operations, understanding these nuances is crucial. It's advisable to continuously monitor market reports, engage with industry professionals, and remain attuned to regulatory changes that might affect global supply chains. Additionally, forming strategic alliances with suppliers who have a reputation for reliability can provide some price stability amidst market volatility. In conclusion, while the cost of zeolite per ton is impacted by diverse factors ranging from natural resource availability to technological and socio-economic influences, maintaining awareness of these elements helps enterprises make informed purchasing strategies. By doing so, they can leverage zeolite's myriad of benefits while navigating the complexities of pricing frameworks in an evolving global marketplace.

4. Geopolitical and Environmental Considerations Political stability in zeolite-rich regions affects mining operations and export capabilities. Similarly, stringent environmental regulations can enhance costs due to the need for compliance with higher environmentally-friendly standards. Both factors can induce price shifts. 5. Market Competition The presence of competitors within the market, offering either alternative materials or different sources of zeolite, adds another layer of pricing complexity. A competitive market can mitigate drastic price changes, yet an unbalanced market where a few companies dominate can lead to increased prices due to monopolistic tendencies. 6. Emerging Market Trends As we move towards a more environmentally conscious world, zeolite's role in promoting cleaner technologies is under the spotlight. Emerging trends include their use in green technologies—like air filtration, wastewater treatment, and renewable energy systems—which can spike demand, thereby influencing pricing. For businesses considering integrating zeolite in their operations, understanding these nuances is crucial. It's advisable to continuously monitor market reports, engage with industry professionals, and remain attuned to regulatory changes that might affect global supply chains. Additionally, forming strategic alliances with suppliers who have a reputation for reliability can provide some price stability amidst market volatility. In conclusion, while the cost of zeolite per ton is impacted by diverse factors ranging from natural resource availability to technological and socio-economic influences, maintaining awareness of these elements helps enterprises make informed purchasing strategies. By doing so, they can leverage zeolite's myriad of benefits while navigating the complexities of pricing frameworks in an evolving global marketplace.

Share