China Kaolin Supplier Top Quality & Versatile Solutions

Back to list

This comprehensive overview explores key facets of China's kaolin industry and practical sourcing considerations:

- Market Impact and Technical Properties

- Processing Technologies and Quality Control

- Manufacturer Competitive Analysis

- Customized Clay Solutions

- Industrial Application Case Studies

- Supply Chain Integration

- Industry Outlook and Developments

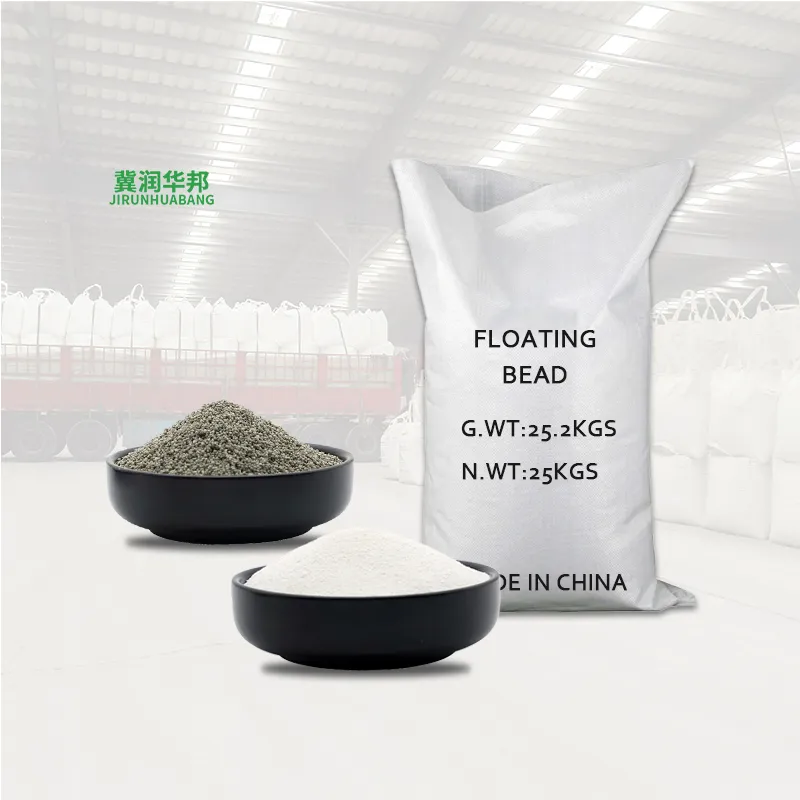

(china kaolin)

China Kaolin Dominance in Global Supply Chains

China produces over 8.5 million metric tons annually, controlling 35% of global calcined kaolin output. Jiangxi, Fujian, and Guangdong provinces hold geological reserves exceeding 1.2 billion tons of premium sedimentary kaolin clay. China's competitive advantages include:

- Integrated mining-to-shipping infrastructure reducing processing costs by 18-22%

- Specialized deep-processing technology parks serving multiple industrial sectors

- Export-oriented production clusters with ISO-certified manufacturing facilities

The National Geological Survey reports consistent brightness values exceeding 88% in premium Southern China deposits. Production yields demonstrate 12% year-over-year efficiency gains since 2020, supported by advanced beneficiation technologies.

Processing Technologies and Quality Control

Leading kaolin china clay manufacturers employ multi-stage processing systems achieving particle size distributions between 0.5-25μm. Modern facilities utilize:

- Magnetic separation technology reducing Fe₂O₃ content to below 0.4%

- Dewatering presses achieving 70% solid cakes before thermal treatment

- Computer-controlled calcination kilns with ±5°C temperature accuracy

Production facilities implement ASTM D7182 standards with laboratory capabilities testing 22+ material parameters. Automated optical sorters combined with expert quality control teams ensure batch consistency, with leading manufacturers reporting less than 0.3% variance in product specifications.

Top Kaolin China Clay Manufacturers Comparative Analysis

| Manufacturer | Annual Capacity | Key Grades | Technology Investments | Export Markets |

|---|---|---|---|---|

| Longyan Kaolin Group | 420,000 tons | Hydrous, Calcined, Surface Modified | Nanometer Grinding, Plasma Treatment | 35 countries |

| Jingdezhen China Clay | 280,000 tons | Ceramic, Paper Coating, Polymer Grade | Electrostatic Separation, AI QC Systems | EMEA specialty focus |

| Sino Kaolin Limited | 380,000 tons | High-Brightness, Functional Fillers | Micronization, Organic Modification | Global industrial conglomerates |

Installation of XRD analytical equipment has tripled since 2021, with top-tier kaolin china clay manufacturers investing $160+ million in processing technology upgrades. Quality differentiation centers on particle morphology control and contaminant reduction capabilities.

Customization Solutions for Industrial Applications

Major suppliers maintain Technical Service divisions providing application-specific modifications:

- Polymer Formulations: Silane-modified grades for PA6 composites improving flexural strength by 25%

- Paper Coatings: Engineered particle size distributions enhancing gloss at 30% lower loading levels

- Specialty Ceramics: Controlled shrinkage formulations enabling precise tolerance components

Development pipelines include kaolin clay optimized for lithium battery separators and pharmaceutical excipients. Pilot plant capabilities allow for 500kg sample batches with lead times averaging 18 working days from specification to delivery.

Industrial Application Case Studies

South Korean Paper Mill Integration: Chinese calcined kaolin clay reduced coating costs by $42/ton while maintaining 85 TAPPI brightness standard. Production line efficiency increased 7% through optimized rheology properties.

German Automotive Composite Project: Surface-modified kaolin china clay provided 15.3% weight reduction in PP components for door panels while meeting OEM impact resistance requirements. Thermal stability testing confirmed performance at continuous 145°C environments.

Supply Chain Integration Models

Progressive manufacturers implement comprehensive logistics frameworks:

- Containerized mineral shipments with RFID tracking systems

- Regional warehousing networks in Rotterdam, Houston, and Dubai

- Inventory management portals providing real-time stock visibility

Quality assurance extends through blockchain documentation from extraction to loading. International clients benefit from standardized Incoterms® implementation and dedicated export compliance teams ensuring smooth customs clearance. Bulk vessel shipments offer 17-23% cost advantages compared to containerized transport.

China Kaolin Industry Evolution

Government initiatives including the Mineral Deep-Processing Development Plan target 8% annual production value growth through 2030. Current development focuses on:

- Specialty chemicals production for high-purity alumina extraction

- Ecological restoration standards at mining operations

- Digital supply chain integration using IoT monitoring

With 65% of kaolin china clay manufacturers now certified under ESG frameworks, the industry demonstrates sustainable advancement. Technical cooperation agreements with international research institutions position China for continued market leadership across industrial kaolin clay applications.

(china kaolin)

FAQS on china kaolin

Q: What is China Kaolin used for?

A: China Kaolin is primarily used in ceramics, paper coating, and paint production. Its fine particle size enhances product brightness and durability. It's also popular in cosmetics and pharmaceuticals for its smooth texture.

Q: How to identify quality kaolin clay from China?

A: Quality Chinese kaolin clay has high whiteness (>85%), low grit content, and consistent particle size. Reputable kaolin china clay manufacturers provide ISO-certified lab reports verifying alumina/silica ratios. Premium grades exhibit excellent plasticity and fired brightness.

Q: Where are major kaolin china clay manufacturers located?

A: Major Chinese kaolin producers cluster in Jiangxi, Fujian, and Guangdong provinces. Leading hubs include Longyan (Fujian), Maoming (Guangdong), and Suzhou (Jiangsu). These regions offer rich deposits and advanced processing facilities near shipping ports.

Q: Why choose China kaolin over other origins?

A: China kaolin offers competitive pricing without compromising quality, with production volumes securing stable supply. Advanced calcination technology delivers unique properties like ultra-fine particle distribution. Strict export controls ensure consistent chemical composition for industrial applications.

Q: What certifications should china kaolin clay manufacturers have?

A: Reliable manufacturers hold ISO 9001 for quality management and ISO 14001 for environmental compliance. Additional certifications like Reach (EU), FDA (US), and GB/T standards validate product safety. Eco-mining certifications demonstrate sustainable extraction practices.