Mica Sheet Size and Price White Mica Sheet Price List & Wholesale Offers

Back to list

- Introduction to mica sheet size and price

in the global market - Key technical advantages and unique properties of mica sheets

- In-depth analysis of mica white sheet price trends

- Comparative study: Major manufacturers & price list data

- Customization options and tailored solutions for mica sheets

- Application scenarios and real-world industrial cases

- Conclusion: Current and future value of mica sheet size and price

(mica sheet size and price)

Understanding Mica Sheet Size and Price in Today’s Market

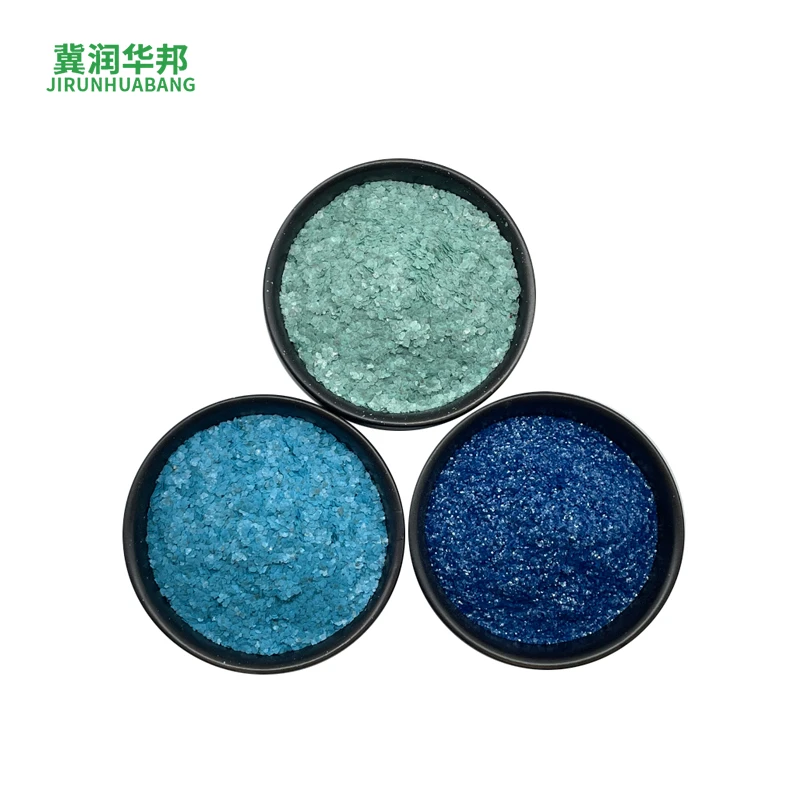

Mica sheet size and price are crucial factors for industries spanning electronics, construction, and energy. With the global mica market projected to reach over USD 671 million by 2028, a steady demand for reliable insulating materials underpins evolving price strategies and sheet dimensions. Consumers are seeking high-performance, cost-competitive mica solutions—reflected in both available sizes (usually ranging from 0.1mm to 3mm thickness and customizable widths) and diverse pricing models. Price sensitivity is influenced by raw mica grade, region, manufacturing technique, and end-use sectors. For instance, dielectric and thermal properties, sheet flexibility, and environmental compliance standards further impact both the final price tag and choice of size for specific industrial processes. Understanding this landscape is essential for procurement and application engineers alike.

Technical Superiority: Data-driven Advantages of Mica Sheets

The technical superiority of mica sheets lies in their unique blend of thermal endurance, dielectric strength, and moisture resistance. Withstanding temperatures up to 1000°C, mica sheets provide unmatched protection in high-heat environments such as foundries, power generation stations, and electronics assembly. Dielectric strengths typically exceed 20 kV/mm, rivaling or outperforming synthetic alternatives. Compared to materials like fiberglass or ceramic components, mica boasts lower water absorption rates (less than 1.5%) and higher chemical inertness. For industries prioritizing consistent performance and minimal maintenance, these metrics can drive significant operational savings. Additionally, the physical structure of mica allows for razor-thin sheets, down to 0.025 mm, enabling use in space-constrained devices. Industries integrating mica solutions report reduced failure rates over extended product lifespans, supporting lower total cost-of-ownership even when the mica sheet price list shows premium points.

Mica White Sheet Price Evolution and Market Drivers

Mica white sheet price is influenced by several market catalysts. Purity and visual clarity directly impact cost, with higher-grade white mica commanding up to 40% more than mixed-color alternatives. Price volatility also derives from labor-intensive mining in major producing regions such as India, China, and Madagascar. As sustainability standards rise, demand for ethically sourced white mica is pushing prices upwards. For example, export-quality white mica sheets may range from $11/kg–$35/kg, while industrial bulk may be available between $7/kg–$18/kg depending on quality and processing complexity. Long-term contracts and spot market purchases display notable gaps, with supply constraints (tied to environmental regulation or logistical disruptions) occasionally causing short-term spikes of 5–10%. Engineers and buyers should monitor not only current mica white sheet price averages but global supply chain signals for accurate forecasting.

Manufacturers Compared: Mica Sheet Price List and Market Profiles

Comparing leading manufacturers unveils significant price and quality differentials in the mica market. The following table presents a direct comparison across key criteria:

| Manufacturer | Country | Mica Sheet Size Range (mm) | Standard Price/Sheet | Lead Time (days) | Certifications |

|---|---|---|---|---|---|

| Premier Mica Co. | India | 0.2–2.0 x 600 x 1000 | $6.80 – $8.50 | 12–18 | ISO 9001, RoHS |

| Cogebi S.A. | Belgium | 0.1–3.0 x 1020 x 1200 | $10.00 – $20.00 | 20–28 | UL, ISO 14001 |

| Purple Mica Tech | China | 0.15–1.5 x 500 x 1250 | $5.20 – $7.60 | 8–15 | CE, Reach |

| Mica Insulation Ltd. | UK | 0.2–2.5 x 1000 x 1200 | $9.00 – $14.00 | 10–21 | EN 45545, UL |

These differences offer buyers flexibility. Fast lead times suit urgent repairs and prototyping, while top-end certifications are crucial for regulated markets. Bulk orders typically come with negotiated price reductions, underlining the value in maintaining direct supplier relationships. The mica sheet price list continues to evolve as suppliers expand automated production and compliance assurance, fostering both cost efficiency and product reliability.

Customization and Bespoke Solutions for Mica Sheets

For industries with specialized performance requirements, off-the-shelf mica products may not suffice. Manufacturers are increasingly offering tailored solutions, customizing not just mica sheet size and price, but also layering strategies, surface treatment, and composite integration. For example, electrical insulation boards for transformers may demand thickness tolerances below ±0.02 mm or integration with resins to enhance moisture barriers. Leading suppliers collaborate with engineers during design phases, sometimes running pilot batches with adjusted sizing (from 500 x 800 mm small lots up to 1300 x 2500 mm continuous sheets) and refractive coating applications. While bespoke options can add 5%–15% to initial cost, lifecycle analyses show reduction in maintenance intervals—often recouping this premium cost within a single fiscal year. Key challenge remains balancing time-to-market with the intensive sample validation protocols of critical applications.

Application Cases: Real-World Uses and Measured Outcomes

Real-world deployment of mica sheets underlines versatility and value across industrial sectors. In high-frequency circuit production, using precision-cut mica sheets resulted in a 12% reduction in signal loss versus polymer substitutes. Thermal shielding applications in rolling mills report downtimes falling by 18% post-mica integration, attributed to superior temperature endurance and chemical resistance. Automotive manufacturers leveraging mica insulating gaskets on EV battery modules have documented enhanced safety margins and 20% longer component lifespan. In aerospace, thin, flexible mica composites are increasingly chosen for their negligible outgassing and high dielectric stability at altitude. Each scenario affirms that optimal selection of size, grade, and supplier—data-backed by price list comparisons and technical specs—translates directly to improved productivity and product reputation in global markets.

Conclusion: The Strategic Role of Mica Sheet Size and Price

The evolving narrative of mica sheet size and price demonstrates its pivotal role at the intersection of cost management, innovation, and industrial sustainability. Competitive price lists, abundant customization options, and quantifiable performance gains empower engineers and buyers to make data-centric choices. As market demand continues shifting toward specialized, high-purity solutions and ethical sourcing, the spectrum of available sheet sizes and price points grows richer. Ongoing investments in mining transparency, advanced processing, and supplier partnerships will continue to shape the mica market, offering both tactical savings and strategic value. Stakeholders seeking the optimal balance between specification precision, price efficiency, and regulatory compliance will invariably find mica solutions outperforming in the most demanding scenarios, ensuring strong return on investment for years ahead.

(mica sheet size and price)